By 2020, the travel industry will have the highest percentage of online payment of any industry worldwide.1

Clearly, more and more customers prefer to pay tour operators and DMCs online. However, finding a good payment partner is not an easy task for tour operators.

Here are the three main points to consider:

1. Your margins - provide an alternative to credit cards

The most common form of travel payment is credit card (42%). However, credit card payments come with hefty fees. Any payment with a Merchant Category Code connected to “Travel” has a much higher Interchange fee, which means higher fees for tour operators. It’s how credit card companies pay for all the miles and other goodies they give to users paying with a credit card for travel.

It is thus important that you can offer your customers a payment alternative with much lower fees to you. However, asking users to wire money or to send you a check does not match the professional brand you have built.

It could also hurt your conversion and make you lose customers. Therefore, make sure that your payment provider offers you an easy way to collect bank transfers online (also called ACH payments in the US) online.

WeTravel gives you the flexibility to offer both ACH and card payments easily online, with ACH rates of only 1%. This way, you can keep your costs in check, all while still offering your users maximum flexibility.

2. Getting accepted - find a payment provider that accepts tour companies

Many payment providers do not offer service to tour operators. This is because traditionally, there are a lot of bad apples out there and tour operators collect payments long before the service is provided. Therefore, it’s easier for payment providers to just exclude the whole category of “tour operators”. Some large players like PayPal compensate for that risk by charging rates as high as 4-5%.

Therefore, make sure to choose a payment provider that knows travel well and accepts tour operators. Specialized companies like ours have deep industry expertise and are more likely to provide you service at reasonable rates.

3. Your brand - payment collection & excellent customer support

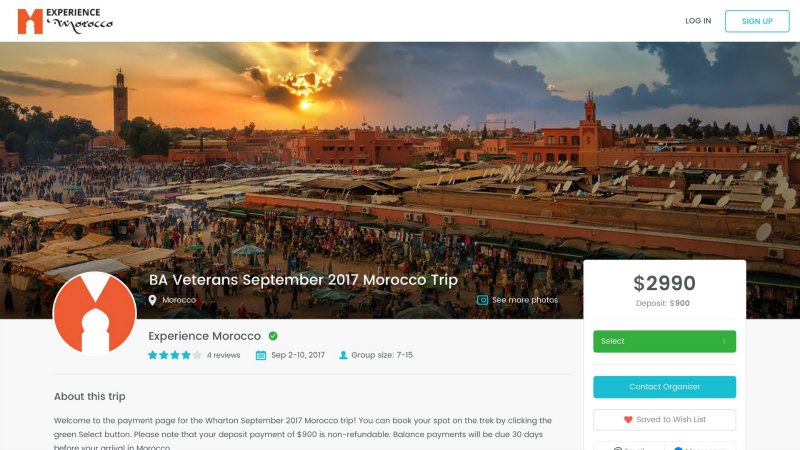

You should make sure that the way you accept payments represents the amazing brand you have built. Don’t send customers to a PayPal site, which makes your company look small and unprofessional. Make sure that you can send invoices and booking pages that look great and carry your logo. Below, you see an example of Experience Morocco using WeTravel’s payment pages:

Your payment provider is a direct extension of your business. You need to make sure that the payment provider’s customer support is top notch. Not only do you want your customers to have a flawless experience, you also want the payment provider to answer your questions.

Because we all know the feeling of waiting for a large payment and no-one giving any clear answer when it will finally be made available to you.

Make sure that the payment provider you are working with has excellent customer support, including at least a phone helpline that is responsive and accurately staffed.

If you would like to know more about WeTravel’s payment services for tour operators, please get in touch at wetravel.com.